Published on December 22, 2020

Rajeev Tanna, Head of Risk Management & Internal Compliance at Tata Consulting Engineers (TCE), provided insights into the lifecycle approach to ‘Project Risk Management’ at the 278th EDGE Webinar hosted on December 2, 2020.

TCE is a design, engineering and project management consulting firm whose operations are structured across three clusters: Infrastructure, plant engineering and design, and project management consultancy.

Risk Management Culture at TCE

According to Mr Tanna, the company has strengthened its risk management culture over the last few years by adopting a lifecycle approach to project risk management. This covers all the stages of TCE’s business from proposal and pre-bid to the bid stage and winning the bid to the project’s execution and completion.

For instance, risks at the pre-bid stage include country or location risk, risk to business strategy, and alliance risks, among others. Then, the company has a comprehensive qualitative and quantitative approach for assessing the bid risk, which includes ascribing a risk value that can then be added to a bid price and woven into project decisions. And, it has developed a customised approach to assess projects under execution.

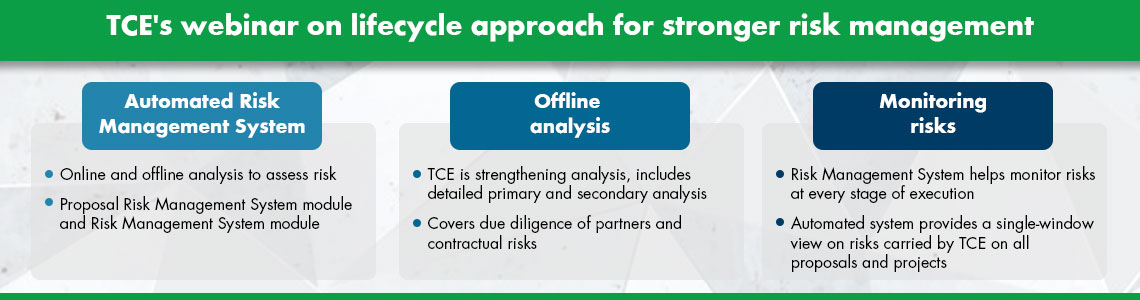

Automated Risk Management System

Project managers and risk officers use online and offline analysis to assess risks. TCE developed an Automated Risk Management System five years ago, which has proved to be very effective in managing risks. This includes a Proposal Risk Management System (PRMS) module for the proposal stage and a Risk Management System (RMS) module for the execution stage. The level of review – basic or detailed – depends upon the bid size and project complexity.

The PRMS generates a Bid Risk Register, which covers every aspect from the project’s viability and technical complexity to competition and contractual risks.

Offline Analysis

The company is also now strengthening its offline analysis, which includes detailed primary (past experience with same client or similar project) and secondary (client details and financials, financing closure agreements, etc.) analysis, besides covering due diligence of partners and contractual risks as also a quantitative analysis of cash flows, among other things.

According to Mr Tanna, the company has gleaned various learnings from the bid risk assessment, such as on managing multiple iteration demands by clients and scheduling delays and even on enforcing the force majeure clause, which has gained relevance with the Covid-19 outbreak.

Monitoring Risks

Meanwhile, the RMS module not only enables project managers to monitor risks at every stage of the project’s execution but it has also fostered a structured review mechanism through a pre-read project risk review template. What’s more, the automated system provides a single-window view on the risks carried by TCE on all proposals and projects for each business unit and across the entire company.

Thus, as TCE’s experience has shown, a strong and efficient risk management system across a company’s business lifecycle can not only aid in decision-making but also help safeguard the bottom-line.